General Instructions

Purpose of Form

Use Schedule G (Form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote.

Who Must File

Every corporation that answers “Yes” to Form 1120, Schedule K, Questions 4a or 4b, must file Schedule G to provide the additional information requested for certain entities, individuals, and estates owning the corporation’s voting stock.

Constructive Ownership of the Corporation

For purposes of Schedule G (Form 1120), the constructive ownership rules of section 267(c) (excluding section 267(c)(3)) apply to ownership of interests in corporate stock and ownership of interests in the profit, loss, or capital of a partnership. An interest in the corporation owned directly or indirectly by or for another entity (corporation, partnership, estate, or trust) is considered to be owned proportionately by the owners (shareholders, partners, or beneficiaries) of the owning entity. Also, under section 267(c), an individual is considered to own an interest owned directly or indirectly by or for his or her family. The family of an individual includes only that individual’s spouse, brothers, sisters, ancestors, and lineal descendants.

An interest will be attributed from an individual under the family attribution rules only if the person to whom the interest is attributed owns a direct or an indirect interest in the corporation under section 267(c)(1) or (5). However, for purposes of these instructions, an individual will not be considered to own, under section 267(c)(2), an interest in the corporation owned, directly or indirectly, by a family member unless the individual also owns an interest in the corporation either directly or indirectly through a corporation, partnership or trust.

Example 1. Corporation A owns, directly, a 50% interest in the profit, loss, or capital of Partnership B. Corporation A also owns, directly, a 15% interest in the profit, loss, or capital of Partnership C and owns, directly, 15% of the voting stock of Corporation D. Partnership B owns, directly, a 70% interest in the profit, loss, or capital of Partnership C and owns, directly, 70% of the voting stock of Corporation D. Corporation A owns, indirectly, through Partnership B, a 35% interest (50% of 70%) in the profit, loss, or capital of Partnership C and owns, indirectly, 35% of the voting stock of Corporation D. Corporation A owns, directly or indirectly, a 50% interest in the profit, loss, or capital of Partnership C

(15% directly and 35% indirectly), and owns, directly or indirectly, 50% of the voting stock of Corporation D (15% directly and 35% indirectly).

Corporation D reports in Part I that its voting stock is owned, directly or indirectly, 50% by Corporation A and is owned, directly, 70% by Partnership B.

Example 2. A owns, directly, 50% of the voting stock of Corporation X. B, the daughter of A, does not own, directly, any interest in Corporation X and does not own, indirectly, any interest in Corporation X through any entity (corporation, partnership, trust, or estate). Therefore, the family attribution rules do not apply and, for the purposes of Part II, the 50% interest of A in Corporation X is not attributed to B.

Example 3. A owns, directly, 50% of the voting stock of Corporation X. B, the daughter of A, does not own, directly, any interest in X but does own, indirectly, 10% of the voting stock of Corporation X through Trust T of which she is the sole beneficiary. No other family member of A or B owns, directly, any interest in Corporation X nor does any own, indirectly, any interest in Corporation X through any entity. Neither A nor B owns any other interest in Corporation X through any entity.

For the purposes of Part II, the 50% interest of A in the voting stock of Corporation X is attributed to B and the 10% interest of B in the voting stock of Corporation X is attributed to A. A owns, directly or indirectly, 60% of the voting stock of Corporation X, 50% directly and 10% indirectly through B. B owns, directly or indirectly, 60% of the voting stock of Corporation X (50% indirectly through A and 10% indirectly through Trust T).

Specific Instructions

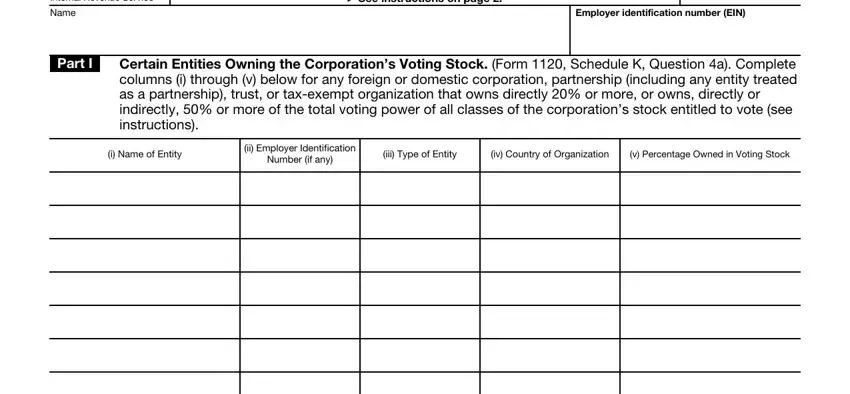

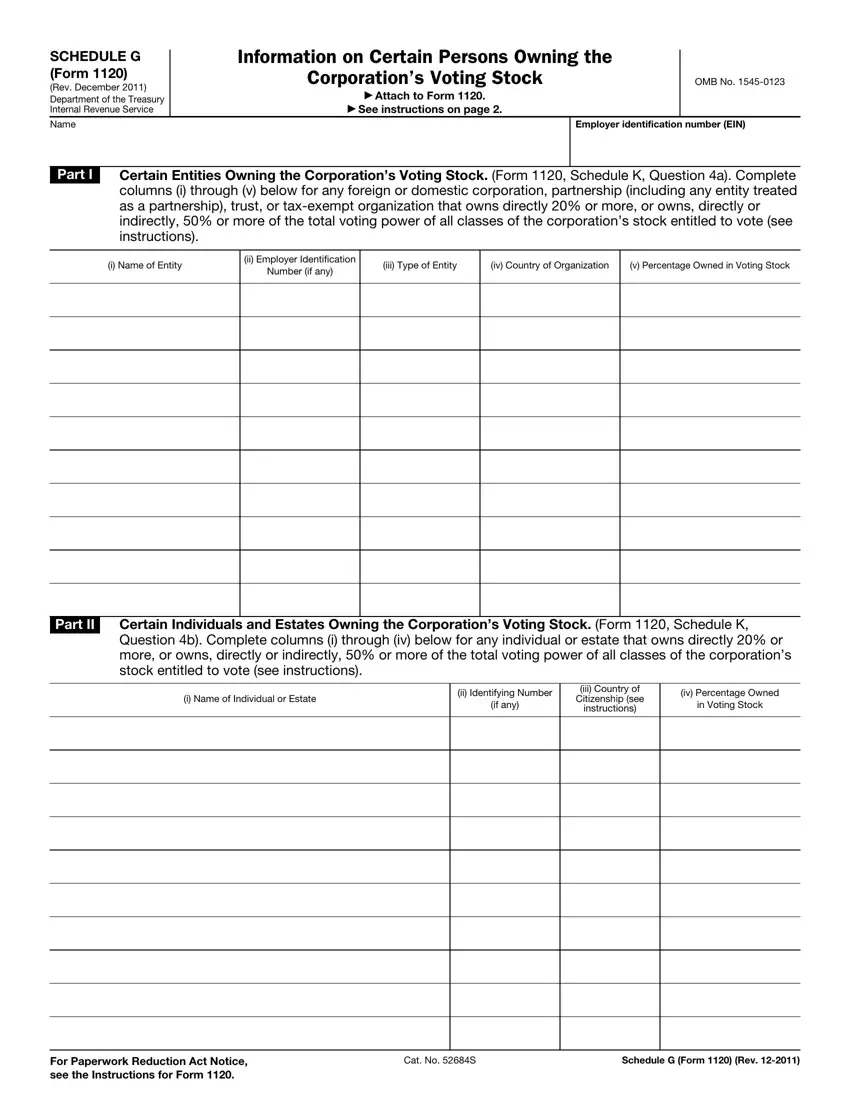

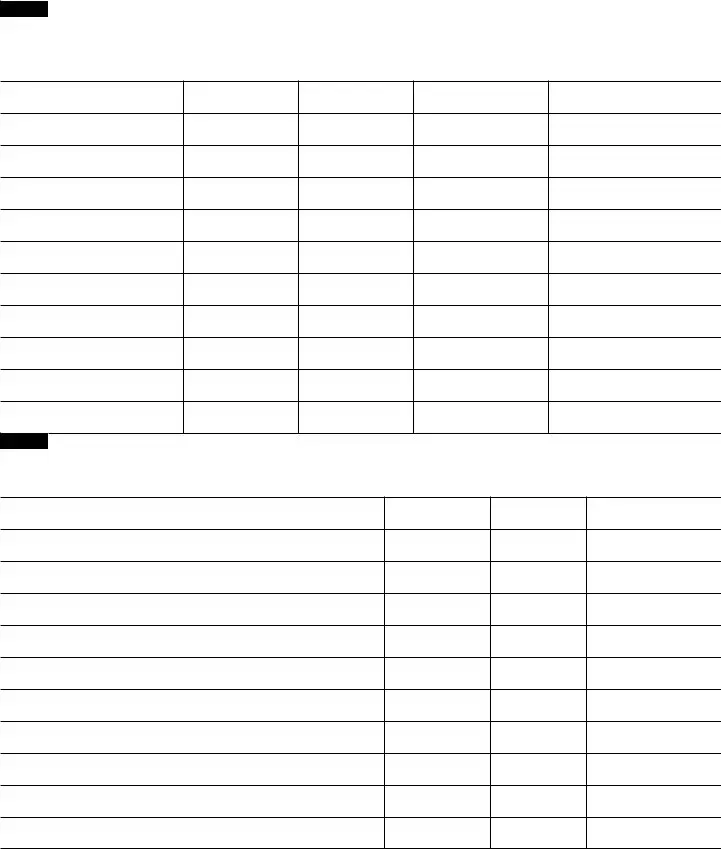

Part I

Complete Part I if the corporation answered “Yes” to Form 1120, Schedule K, Question 4a. List each foreign or domestic corporation, partnership, trust, or tax- exempt organization that owns, at the end of the tax year, directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote. Indicate the name of the entity, employer identification number (if any), type of entity (corporation, partnership, trust, or tax- exempt organization), country of organization, and the percentage owned, directly or indirectly, of the voting stock of the corporation.

For an affiliated group filing a consolidated tax return, list the parent corporation rather than the subsidiary members. List the entity owner of a disregarded entity rather than the disregarded entity. If the owner of a disregarded entity is an individual rather than an entity, list the individual in Part II.

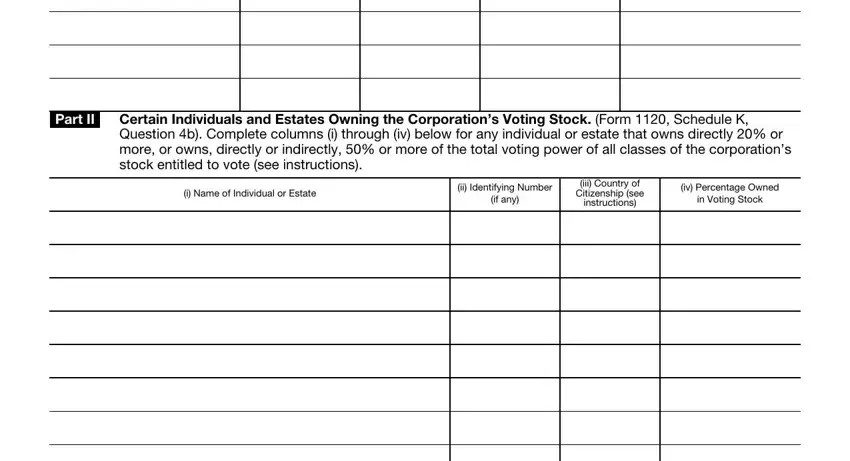

Part II

Complete Part II if the corporation answered “Yes” to Form 1120, Schedule K, Question 4b. List each individual or estate that owns, at the end of the tax year, directly 20% or more, or owns, directly or indirectly, 50% or more, of the total voting power of all classes of the corporation’s stock entitled to vote. Indicate the name of the individual or estate, taxpayer identification number (if any), country of citizenship (for an estate, the citizenship of the decedent), and the percentage owned, directly or indirectly, of the voting stock of the corporation.